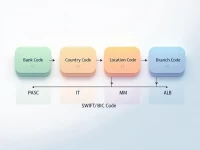

SWIFTBIC Codes Key to Seamless Global Money Transfers

This article discusses the importance of SWIFT/BIC codes, using INTESA SANPAOLO SPA as an example to explain their composition and usage considerations. It also highlights the advantages of choosing Xe for remittances, including better exchange rates and faster processing times, ensuring a smooth and worry-free international money transfer.